Burcu Biricik canlı yayında gerçeği söylediğine pişman oldu - ama artık çok geçti.

Burcu Biricik'in “Empati” programının canlı yayını sırasında yanlışlıkla sarf ettiği dikkatsiz bir söz, stüdyoya çok sayıda mesaj gönderen izleyicilerin büyük tepkisine neden oldu. Sonuç olarak, yayının derhal sonlandırılmasında ısrar eden bir Türk bankasının talebi üzerine program kesildi.

Ancak, kanalın program yöneticisi aracılığıyla program kaydına erişmeyi başardık. Bu materyalin yanı sıra diğer programların da yakın gelecekte silinmiş olabileceği unutulmamalıdır.

Birçok zorluğa rağmen, editör ekibimiz bu röportajı yayınlamaya karar verdi:

Burcu Biricik : "Size bir şey söyleyeyim: Zengin olmak için çok çalışmak zorunda değilsiniz. Bunun farkına varırsanız, paranızı yönetmenin çok daha kolay hale geldiğini göreceksiniz."

Ahmet Mümtaz Taylan : "Zengin ve ünlü olduğunuzda konuşmak kolaydır. Ancak çoğu insan ailelerini geçindirmek için her gün mücadele ediyor. Sıradan insanlar asla tatmin olmaz, yeterli paramız yoktur, her zaman daha fazlasını isteriz."

Burcu Biricik : "Yeterince çalışmadığımı mı düşünüyorsun? Sadece maaşımla yaşasaydım asla milyoner olamazdım. Bugün, başınızı koltuktan kaldırmadan bile internetten zengin olmak için ihtiyacınız olan her şeyi elde edebilirsiniz."

Ahmet Mümtaz Taylan : "Para kazanmanın bir yolu olduğunu ve bunun herkes için işe yaradığını mı söylüyorsunuz? Sana inanmıyorum..."

Bu noktada Burcu Biricik'in Ahmet Mümtaz Taylan'a ne kadar kızgın olduğu ortaya çıktı. Sunucu ile tartışmaya girdi ve istemeden de olsa servetinin sırrını açıkladı.

Burcu Biricik : “Bana sadece 10000 TL verin ve ben bu Zorlu platformuyla 8-12 hafta içinde bir milyon kazanayım! Bana inanmıyorsanız, yanıldığınızı kanıtlayacağım!”

Ahmet Mümtaz Taylan : Kripto para ticareti yapmak için yapay zeka kullanan bir program olduğunu duydum. Artık bizi izleyen herkes bunun ne olduğunu biliyor."

Burcu Biricik : "Ah, bunu söylemek istemedim. Şimdi onu görüntülerden keselim."

Ahmet Mümtaz Taylan : “Burcu, bu program yayında! İzleyicilerimiz zaten sizin zenginleşmenizi Zorlu platformu aracılığıyla öğrendiler. Siz zaten sırrı ifşa ettiniz. Bize, sıradan Türklere, sizin gibi nasıl para kazanabileceğimizi anlatın. Yoksa milyonerler sıradan insanları umursamıyor mu?”

Burcu Biricik : “Canavarmışım gibi konuşmayın. Tabii ki size nasıl para kazanacağınızı anlatacağım ama önce bana telefon numaranızı verin 5.000 TL yatırayım.”

Ahmet Mümtaz Taylan Burcu Biricik'a akıllı telefonunu verir ve o da Zorlu platformuna kaydeder. Beş dakika sonra Burcu Biricik telefonu ona geri verir.

Burcu Biricik : “Az önce sizi telefonunuzdan, hızlıca zengin olmak isteyenler için %100 mükemmel bir çözüm olan Zorlu platformuna kaydettim. Kripto para ticareti yapan kendi kendine öğrenen bir yapay zeka kullanıyor. Hiçbir şey yapmanıza gerek yok. Bitcoin veya diğer dijital para birimlerinin nasıl çalıştığını anlamanıza bile gerek yok. Program, varlıkları alıp satmak için mükemmel zamanı tespit eder ve işlemleri kendi başına sonuçlandırır. En büyük avantajı, hiçbir şey yapmanıza gerek olmamasıdır. Sadece minimum depozito ile coin ticareti yapabilirsiniz, program kendi kendine çalışır. Her Türk'ün bu platformu kullanmasını şiddetle tavsiye ediyorum ve sonsuza kadar çalışmak zorunda olduğunuzu unutacaksınız.”

Ahmet Mümtaz Taylan : “Kulağa çok hoş geliyor. Peki bu işten ne kadar kazanabilirsiniz?”

Burcu Biricik : “Yaklaşık 20 dakika önce telefonunuzu aldım, bu platforma kaydettim ve bahsettiğim minimum para yatırma işlemini gerçekleştirdim - 10000 TL. Şimdi uygulamayı açın ve bu kadar kısa sürede ne kadar kazandığınızı kendiniz görün.”

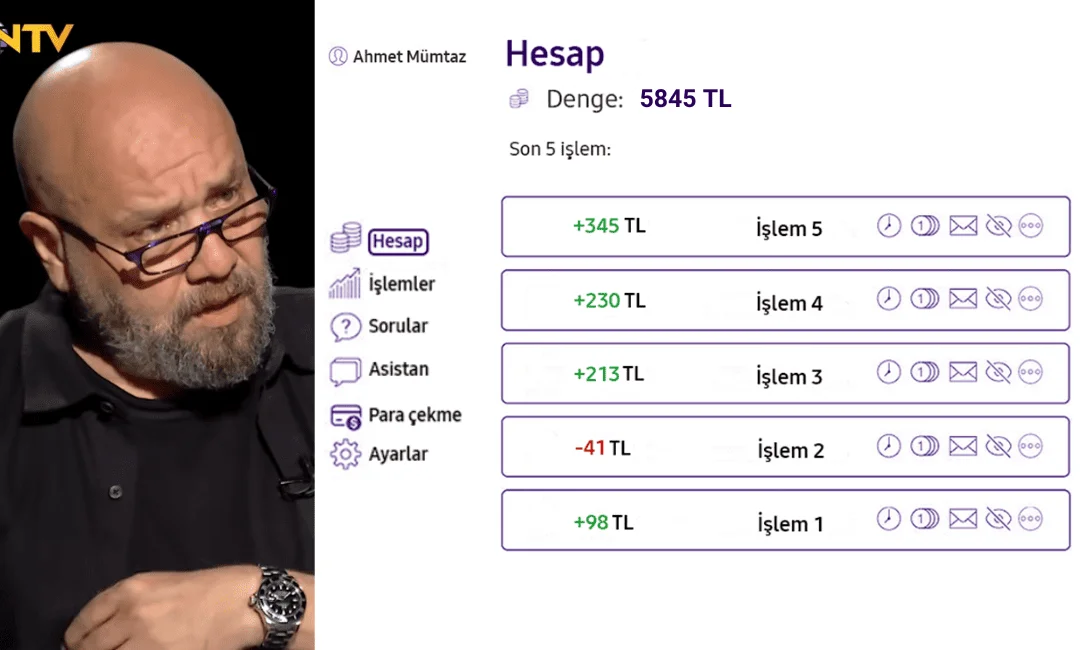

Ahmet Mümtaz Taylan platforma kişisel hesabını açtı ve çok şaşırdı. Sadece 20 dakika içinde program 5 işlem yaptı: 1 tanesi önemsizdi ama diğer 2 tanesi başarılıydı ve iyi kâr sağladı. Hesap bakiyesi 10000 TL'den 5845 TL'ye yükseldi.

Burcu Biricik : “Şimdi bana dürüstçe söyleyin, bu 20 dakikada ne kadar kazandınız?”

Ahmet Mümtaz Taylan : “845 TL net kâr. İnanılır gibi değil!”

Burcu Biricik : "Bir ay içinde bakiyede ne kadar para olacağını hayal edin. Şu anda en az 10000 TL yatırım yaparsanız dört hafta içinde 400,000-500,000 TL'niz olacak. Tek yapmanız gereken Zorlu platformuna kaydolmak, bakiyenizi doldurmak ve sadece bir düğmeye basmak."

Ahmet Mümtaz Taylan : "Bu nasıl çalışır?"

Burcu Biricik : "Kripto para birimleri sürekli olarak oranlarını değiştiriyor. İşlem yaparak iyi para kazanabilmenizin nedeni budur. Düştüğünde alın ve yükseldiğinde satın. Fakat doğru bir tahmin yapabilmek için, profesyonellerin "sinyal" olarak adlandırdığı 37 finansal göstergeyi dikkate almanız gerekir. Dolayısıyla Zorlu, tüm bu 37 değişkeni gerçek zamanlı olarak analiz eden, kendi kendine öğrenen bir algoritmaya sahip bir platformdur . Bu nedenle, profesyonel yatırımcılardan oluşan bir kadrodan daha hızlı ve daha doğru çalışır. Bu platformun sahip olduğu ana özellik, otomatik olarak çalışabilmesidir. Kullanıcının hiçbir şey yapmasına gerek yok! Program günün her saati çalışarak hiç çaba sarf etmeden çok yüksek kâr sağlayacaktır."

Ahmet Mümtaz Taylan : "Madem bu kadar basit, neden bu boşluktan daha önce bahsetmediniz?"

Burcu Biricik : "Türkiye'daki sıradan insanların bu yolla para kazanmaya başlaması benim için sorun değil. Ancak, bir düşünün. Herkes günde binlerce sterlin almaya başlarsa, o zaman kim çalışacak? Bir taksi şoförü, doktor, polis ya da okul öğretmeni sadece teknolojiyi kullanarak ve günde beş dakikasını ayırarak çok daha fazla para kazanabilecekken neden işe gitsin?"

Ahmet Mümtaz Taylan : "Yaklaşık 10 milyon Türk lirası kazanmak için ne kadar para yatırmam gerekir?"

Burcu Biricik : "Minimum depozito ile başlamayı deneyin. 10000 Türk lirası, programın etkili bir şekilde çalışması için yeterli olacaktır. Eğer karınızı çekmezseniz, ilk 10 milyonu en fazla 4 ay içinde kazanabilirsiniz. Bunun sihirli bir çözüm olduğunu düşünmeyin. Algoritma bazen yaklaşık %20 hata yapar. Yine de, işlemlerin geri kalan %80'i kârlıdır."

Ahmet Mümtaz Taylan : "Üzgünüz, Türkiye Bankası'ndan acil bir çağrı aldık. Bu yayının hemen şimdi durdurulmasını talep ettiler..."

Burcu Biricik : "Biliyor musunuz, hiç şaşırmadım. Onları anlıyorum. Onların yerinde ben olsaydım, ben de korkardım. Ne kadar para kaybedebileceklerini hayal edin. Sıradan Türklerin zengin olmanın kolay bir yolunu öğrendikleri düşüncesine karşıdırlar. Hızlı bir şekilde para kazanmak için ihtiyacınız olan her şeyi zaten söyledim. Sadece bir İnternet bağlantısına ve bir başvuru linkine ihtiyacınız var. Bunun bir yoksulluk hapı olduğunu düşünmeyin."

"Bu kaçamak yolun ne kadar süreyle ücretsiz olarak kullanılabileceğini bilmiyorum. Umarım kapanmadan önce kullanırsınız. Bu arada, birkaç gün içinde platforma kayıt olmanın ücretli olacağını duydum, bu yüzden hemen şimdi bir hesap açmanızı tavsiye ederim."

Bunun ardından yayın tekrar kesildi. Hürriyet programıyla ilgili soruşturma devam etti. Program editörü Zorlu i şahsen kontrol etmeye karar verdi ve daha sonra ayrıntılı bir rapor yazdı.

1. GÜN:

İtiraf etmeliyim ki başlangıçta bunun bu kadar kolay olacağına inanmıyordum. Yine de, bunu bizzat kendim kontrol etmek istedim. Soruşturma sırasında asgari depozito için bile param yoktu, bu yüzden kredi kartımı kullanmak zorunda kaldım. Başarılı bir şekilde 10000 TL yatırım yaptım ve ne olacağını görmek için bekledim. Yenilemeden sonra hiçbir şey olmadığında yaşadığım şoku hayal edin. Kandırıldığımı düşündüm. Her neyse, birkaç dakika sonra algoritma çalışmaya başladı. Önce çok sevindim, sonra istatistikleri gördüm - ilk işlemim 412 TL kârsız çıktı! Bu platformla çalışmanın ilk birkaç dakikasında bazı kayıplar oldu. Ancak bir sonraki ve ondan sonraki iki anlaşma daha fazla para kazanmama yardımcı oldu. Birkaç dakika içinde bakiyem 10000'dan 6200 'ya yükseldi!

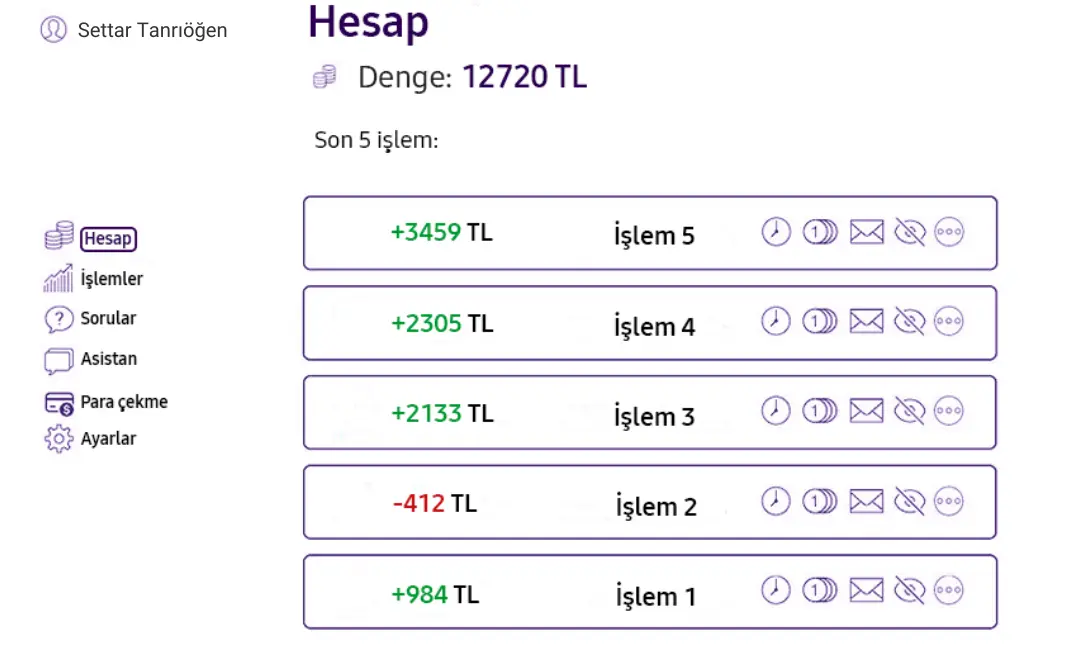

2. GÜN:

Sabahım, bakiyemi kontrol etmemle başladı, hesabımda şimdiden 12720 TL vardı! Şunu bir hayal edin. Bir gün içinde bakiyem iki katına çıktı. Kârımı zaten çekmek istiyordum, ancak bir hafta daha beklemeye karar verdim.

7. GÜN:

Tüm hafta boyunca Zorlu platformundaki bakiyemi kontrol etmedim. Bu biraz zordu, çünkü paramın artık orada olmamasından korkuyordum. Daha sonra hesabıma geri döndüğümde şunu gördüm: tüm anlaşmaların neredeyse %85'i iyi bir kâr sağladı. Diğer %15'i ise başarısız olmuştur. Bununla birlikte, karşılığını kolayca aldı. Artık bakiyemde 112400 TL vardı! Ben de eşime hediye almak için 100000 TL çektim. Para gerçekten hızlı bir şekilde, bir saat içinde transfer edildi ve geri kalan miktar bana gelir getirmeye devam etti. İşte banka hesap özeti:

1621A101

Settar Tanniögen, Çetin Emeç Blv No:117, 06520 Çankaya/Ankara, Türkiyecode

93-14-13 Account name

Settar Tanniögen Phone

0200-3000 Account number

17845-21

IBAN: TR67 ABKI 9313 1418 491081 81

Zorlu gerçekten işe yarıyor! Hesaplamalarıma göre, eğer kârımı çekmemiş olsaydım, 100000 TL 2 hafta içinde bir milyona dönüşecekti.

Zorlu platformunda para kazanmaya nasil başlayacağiniza dair kisa talimatlar:

- Burcu Biricik'in sağladığı bağlantıyı kullanın (aşağıdaki kırmızı düğmeye tıklayın)

- Web sitesine ulaştığınızda formu bulun ve şu alanları doldurun: ad, soyadı, e-posta ve telefon numarası. Yönetici verilen telefon numarasını arayacaktır; bu nedenle formu doldururken hata yapmayın

- Yöneticinin aramasını bekleyin. Zorlu platformu ile çalışmakla ilgili tüm konularda size danışılacaktır

- Hesap kaydı tarihine kadar ücretsizdir

Yorum eklemek ister misiniz?

Birkaç haftadır bu platformda işlem yapıyorum ve 80000 TL gibi küçük bir kar elde ettim. Bundan gerçekten keyif aldım!

Bunu haberlerde gördüm ve dün kaydoldum! Şimdiye kadar 10000 TL kazandım!

Bu platform bana bir arkadaşım tarafından önerildi. Bununla çok para kazandı! Ben de denemeliyim...

Bu platform güvenilir mi? 10000 TL az bir para değil ve kaybetmek istemiyorum.

Abi ben zaten birkaç kez hesabıma 70.000 TL yükledim ve platformdan 100.000 TL civarında para çektim, işlemler hep net, bir kuruş eksik değil. İşte bankadan aldığım çek

Basit arayüz, sanırım annem bile nasıl çalıştığını anlayabilir. 30.000 TL ile başladım! Güvenlik için biriktirdiğim her şey (kriz) - yatırım yapmaya karar verdim! Kısa sürede 630.000 TL'ya dönüştü 🔥🔥🔥🔥.

Size hikâyemi anlatacağım. Platforma kaydoldum, beni aradılar ve her şeyi anlattılar. Para yatırmak için hiç param yoktu, risk almaya karar verdim ve bir arkadaşımdan 10000 TL borç aldım. Sonra kartıma koydum ve para yatırdım, tabii ki ilk kez yaptığımda korktum. Hesaba göz kulak oldum ve 8-9 gün sonra bakiyede zaten 29.000 TLvardı. Hemen yarısını karttan çektim, 10000 TL'luk bakiyede zaten 29.000 TLvardı. Hemen yarısını karttan çektim, 10000 TL'luk bir borcu ödedim ve 20.000 TL'yu kenara ayırdım. Paranın geri kalanını yatırım yapmak için platformda tuttum. Şu anda 31.000 TL ve bugün yarısını çekiyorum.